A Surprise Drop

Wow! What a week it was. On Aug 4th, Sunday night the markets in Japan dropped historical drops which in turn made the US futures market go bonkers! Quite the surprise.

Hopefully you were able to get some bargain trades in. It can be easy to feed into the news and avoid playing during this time but it you did even for a short term play on the 5th, you would have had a nice weekly return.

If we take a step back, this is starting to reflect some shakiness in the market. Even though we regained all of that back in the course of a week it seems like things are fragile and if institutional traders are leveraging the YEN for trades one should pay closer attention to the markets in Japan.

Here is my analysis for the week of Aug 12th and ahead:

With that said, this surprise drop has alerted retail investors and others to place funds into a safe place for awhile. I see this as GOLD being one of those safe havens which will cause the majority of GOLD ETFs to increase in the near term.

Another curious ETF to consider is LCID (The Lucid Group). They are in the EV category and had their earnings recently. While they had nice results and can prove to be profitable for the next few quarters there was some incidental fringe numbers that made investors turn away from this. I see this continue to deflate over the next 3 weeks starting this week. Yet as continued retail investors shake their funds out I see this as a buy in early September. It is undervalued and an easy alternative to other overvalued EV companies.

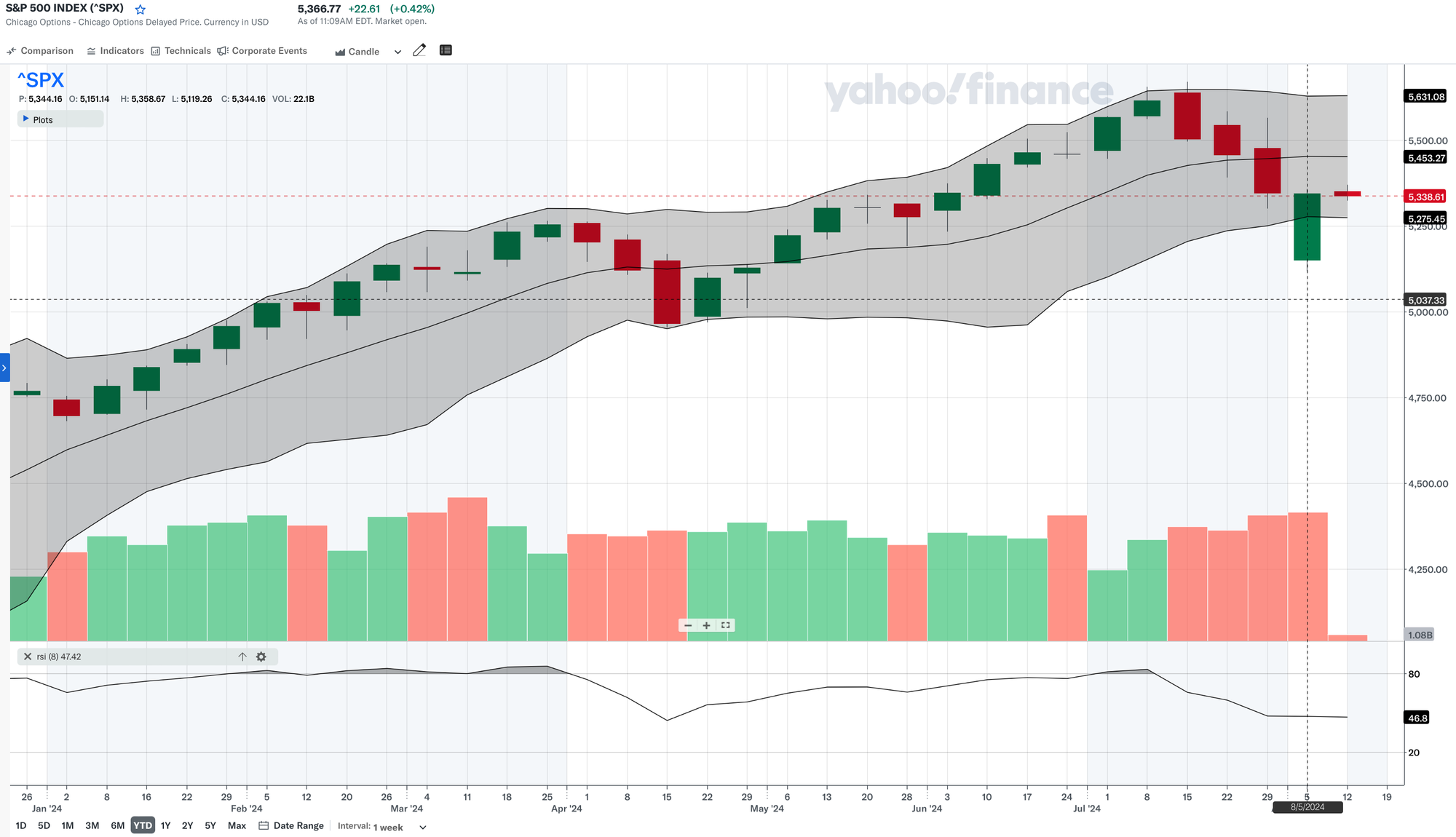

Lastly, let's touch on the SPX. I like this ticker because it is such a great reflection of the US market and influenced by other markets. It's really been volatile and continues to be volatile. With volatility, handled with care there can be some nice wins involved.

Overall the SPX is still bullish but there is some sizable bear energy that has been building in the background. It spurts out here and there but it has yet to reach the full bear run. I'm expecting a decline in the SPX this week leading into next week as the bears just completed the full regain in the last week.