Is The AI Rally Ready For A Breather?

Let's start with the look back on NVDA. This was from over a week ago and many thought that this was going to pump! When we say many what I really mean is retail investors. However, I stated that this was oversold and ready to fall....

Now the result, it fell pretty hard considering triple digit revenues.

Cool but how can I make $$$ on this? Well, one could pull out a portion of their share last week and buy back in on the dip. Or we can consider the wonderful world of options. We'll save that for another time.

What we can see in the chart is that we have a strong resistance at the 131 mark. If you follow that dotted line it has broken it twice but this last week made 6 attempts of touching it and not passing it. NO PASS ZONE. The bears set up their defense.

Now this doesn't mean that it'll never pass that area between 131 and 140 but it will need some oomph to get thru and pass that. My sense is that this will continue to fall for the next week until we have more news of the upcoming rate cut. So this could be a buy in opportunity or wait until the next peak.

Alright, now for our next contestant...APPLE. Yes the moment that we have been waiting for the new AI phone. They announce all the details and more on their stack on 9/9 at 10am PT. We can treat this as a mid-earnings statement that allows retail and institutions to invest. Steve Jobs knew exactly how to create news and cash flow outside of earnings. Smarty!

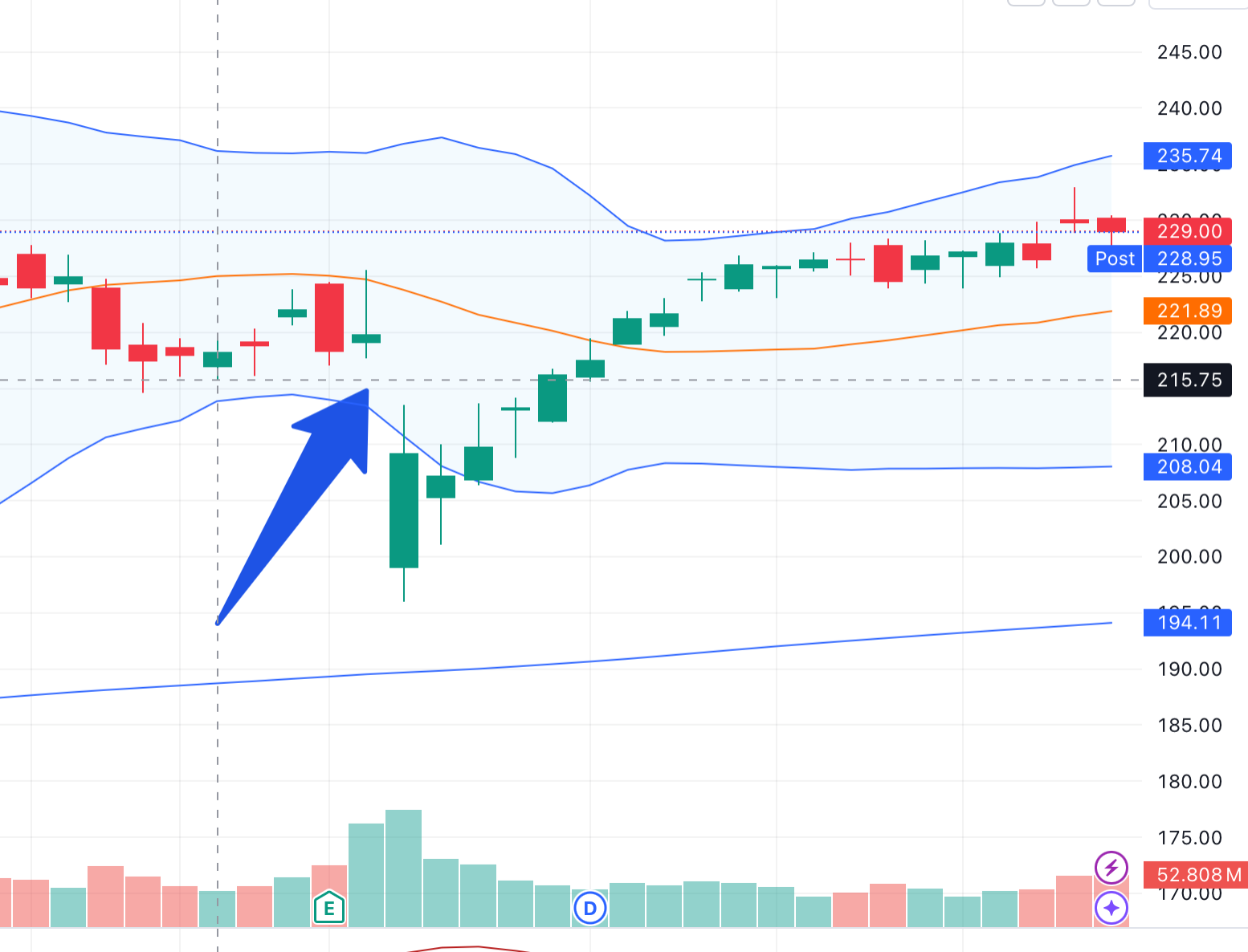

Let's open this chart up to air things out a bit.

Question: Is this chart overvalued?

What we can see is that the All Time High (ATH) happened in July. And that black dotted line on May 2nd was the 'surprise' earnings that gave this an impressive climb for days and into months. Yet the latest earnings, produced an institutional unloading with some retail filling in the gaps.

Now we are a few points from reaching the ATH again. Retail will be reminded to buy in all next week with the press run that is already happening. So do we feel that AI as Siri in your pocket on NEW PHONES not old ones will provoke more to buy. How will that influence the stock?

My sense is it will run up for the next week but do we believe the AI as the hook will allow it to run past the ATH. What I do know is there is a GAP (blue arrow) in the chart that remains empty. This means the Bears will sometime in the future push the stock down so they can regain their position. And there is already resistance forming in the last 11 days.

If it were me, I would either wait to buy in once it fills that GAP. Or even better place a swing put option in place for greater leverage.

Time will tell.

Jamie