The Bears Had Some Honey

How about that?!

This week was fun wasn't it. We had surges of optimism leading up the Fed speaking on the 31st where it was 'alluded' that a rate cut will happen. I feel like this is a dangling carrot that has been dangling in front of the public for a year now for a single rate cut. The day after on Aug 1st the market rolled into the morning with optimism. It wasn't the banks rolling in but it was YOU. A FOMO that creates euphoria.

If you look back at the previous newsletter UnCRWDed House the analysis was telling us that a dip was coming for the SPX. Boy did it ever and unloaded over 200pts in two days. For those of you thinking how can I win here, it is time to learn options.

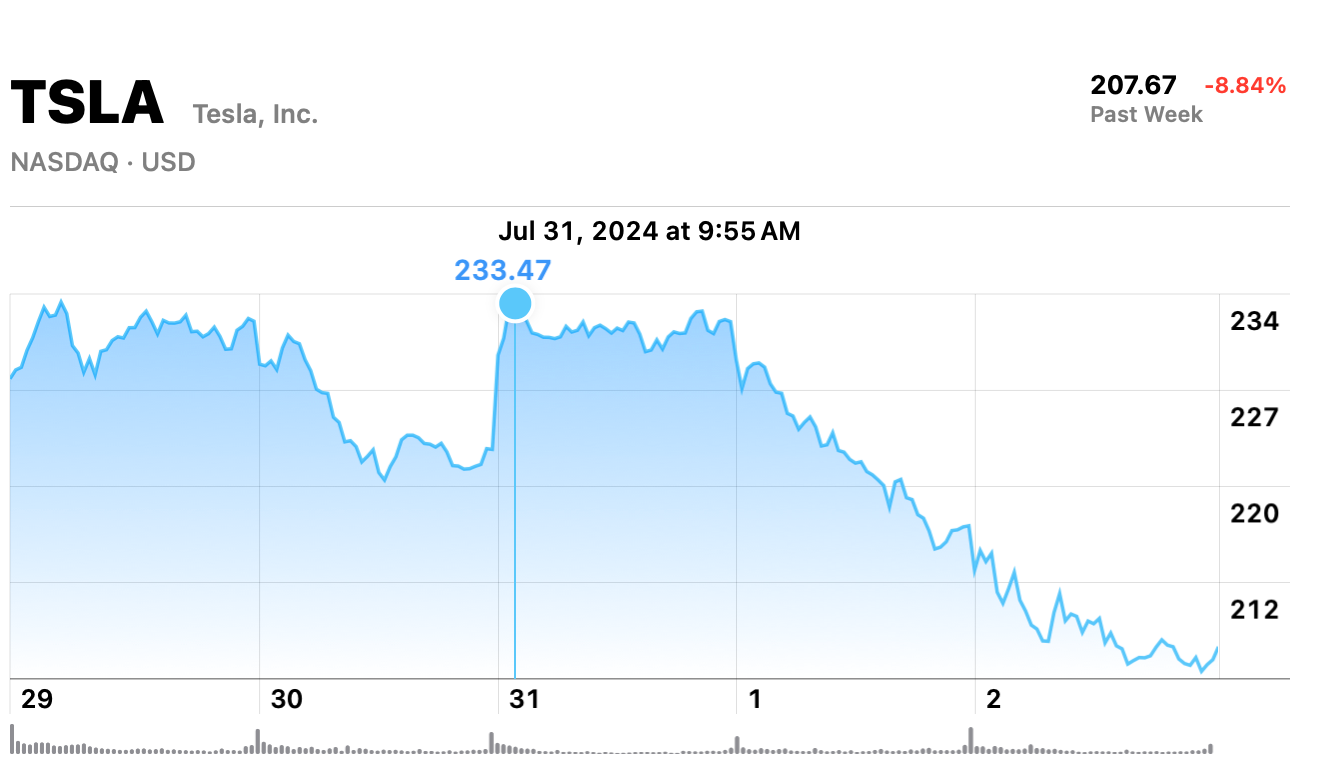

Additionally, if we look at the other piece of analysis on TSLA it was showing overvaluation. The result proved in favor of a Put option. If you placed this early last week you would have been a happy camper.

So now let's have fun and consider what is on the horizon this week. If we think about it usually in cases of a market unloading there is a direction of moving money into safe havens.

Here is my analysis for the week of Aug 5th:

GBTC - Grayscale BTC will begin to have inflows coming back in. I expect more outflows this week but the tide is turning and inflows should begin heading back in after this week of Aug 5th causing the price to increase.

Free members if you want more upgrade the account to get the next two tickers mentioned below.

ZSL - Silver will have some nice opportunity this week as we see money moving into commodities that have more stability during volatility. I see this as an opportunity to buy into for the next two weeks.

In terms of entry into ZSL, I would let Aug 5th and Aug 6th breathe and then consider entering Wednesday, Aug 7th. The exit will become apparent yet it looks like it has opportunity to increase over the next two weeks.

SPX - The S&P is alive and many eyes are on it. I expect volatility for this week which can be fun if you can play it. We may see some inflows on Monday taking advantage of the dip from Thurs / Fri. From my analysis it seems like it won't hold on and have another decline starting mid-week.

In terms of entry of SPX, I recommend the following:

- A Put option this week and would suggest an entry on Wednesday Aug 7th.

- A week of contract with an expiration of August 9th.

- Pick your strike prices at or below the money at the time of buy.

- Exit when it feels comfortable to you.